Axis Mutual Fund Launches Axis Nifty 500 Index Fund

Mutual Fund

(An Open-Ended Index Fund tracking the Nifty 500 TRI)

Highlights:

- Category: Open-Ended Index Fund

- Benchmark: Nifty 500 TRI

- Fund Managers: Mr. Karthik Kumar and Mr. Sachin Relekar

- NFO Period: June 26, 2024 – July 09, 2024

- Minimum Investment: Rs. 100/- and in multiples of Re. 1/- thereafter

- Exit Load:

- If redeemed/ switched out within 15 days from the date of allotment: 0.25%

- If redeemed/ switched out after 15 days from the date of allotment: Nil

Mumbai, June 25, 2024: Axis Mutual Fund, one among the fastest growing fund houses in India, is pleased to announce the launch of its New Fund Offer - Axis Nifty 500 Index Fund. This open-ended index fund aims to replicate the performance of the Nifty 500 Total Return Index (TRI), offering investors broad exposure to India's top 500 companies listed on the National Stock Exchange (NSE). The New Fund Offer (NFO) opens on June 26, 2024, and will close on July 09, 2024. The fund will be managed by Mr. Karthik Kumar and Mr. Sachin Relekar.

India is one of the fastest growing economies globally and could become the third largest economy by 2027. The Nifty 500 Index aims to capture this growth story through the performance of a broad universe of companies, providing investors with diversified exposure to the Indian equity market. Accordingly, the Axis Nifty 500 Index Fund aims to provide returns before expenses that closely correspond to the total returns of the Nifty 500 Index, subject to tracking errors. Therefore, investors who wish to capitalize on this growth opportunity, can consider exposure to this fund.

Mr. B. Gopkumar, MD & CEO of Axis AMC, said "At Axis Mutual Fund, our objective has always been to provide investors with innovative and high-quality investment solutions. The Axis Nifty 500 Index Fund is a simple passive fund designed to offer investors a simple yet effective way to participate in the growth story of a broad spectrum of Indian companies. We believe that the fund's broad-based approach, coupled with the potential for sustainable long-term returns, will serve as a robust vehicle for wealth creation over the long term, making it an attractive option for both new and experienced investors".

Managed by Axis Mutual Fund's experienced team, the fund replicates the broad market exposure of the Nifty 500 Index, representing approximately 92% of India's listed market capitalization. This extensive coverage translates into a well-balanced allocation across market segments, with approximately 73% in large-cap, 17% in mid-cap, and 10% in small-cap stocks.

Who Should Invest?

- Long-term investors seeking broad market exposure to the top 500 companies in India.

- First-time investors looking for a simple and diversified investment option.

- Experienced investors aiming to complement their portfolio with a low-cost, passive investment strategy.

Mr. Ashish Gupta, Chief Investment Officer of Axis AMC, added, "India's robust economic growth and market resilience have been remarkable. With the growing acceptance of passive investing, it is essential to offer our investors products that align with their evolving investment strategies. As India continues to benefit from structural advantages, this fund provides a strategic opportunity for investors to participate in India's dynamic growth story".

Key Attributes of the Axis Nifty 500 Index Fund:

- Diversified Exposure: The fund provides broad exposure to the top 500 companies, ensuring a diversified investment portfolio across sectors and market capitalizations

- Wider Market Cap Coverage: Nifty 500 covers around 92% of India’s listed universe, covering all 21 sectors across Large Cap, Mid Cap & Small Cap companies

- Simple yet Effective: The Nifty 500 Index is a comprehensive benchmark of the Indian equity market, making this fund an ideal choice for investors seeking market-linked equity returns, suitable for all types of investors

- Lower Expenses: As a passively managed index fund, it offers lower expenses compared to actively managed funds, providing a cost-effective investment option

- Aims for Long Term Returns: Nifty 500 Index Fund aims to deliver better risk adjusted returns in the long run

For detailed information on the investment strategy and to view the Scheme Information Document (SID)/Key Information Memorandum (KIM), please visit www.axismf.com.

Source: Axis MF Internal Research as on 1st June 2024

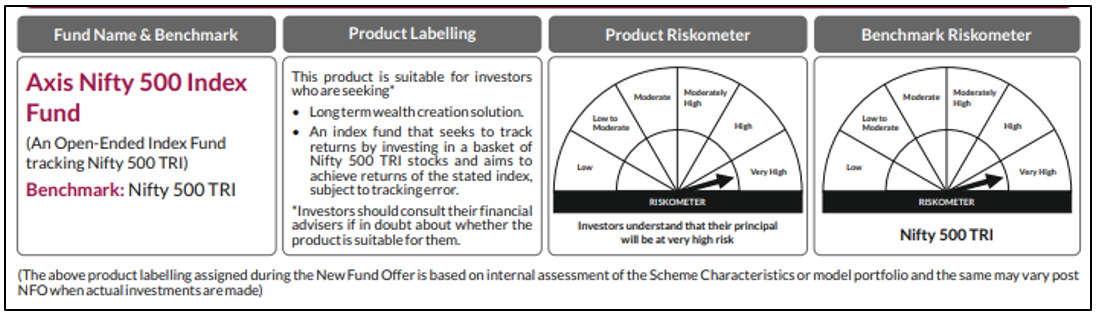

Product Labelling and Riskometer: Axis Nifty 500 Index Fund (an open-ended index fund tracking the Nifty 500 TRI)

About Axis AMC: Axis AMC is one of India`s fastest growing assets managers offering a comprehensive bouquet of asset management products across mutual funds (https://www.axismf.com/), portfolio management services and alternative investments (https://www.axisamc.com/homepage).

NSE Disclaimer: It is to be distinctly understood that the permission given by NSE should not in any way be deemed or construed that the SIDs / Schemes of Axis MF has been cleared or approved by NSE nor does it certify the correctness or completeness of any of the contents of the SIDs. The investors are advised to refer to the SIDs for the full text of the 'Disclaimer Clause of NSE.

Axis Nifty 500 Index Fund is not sponsored, endorsed, sold or promoted by NSE Indices Limited (formerly known as India Index Services & Products Limited (IISL)). NSE Indices Limited does not make any representation or warranty, express or implied (including warranties of merchantability or fitness for particular purpose or use) and disclaims all liability to the owners of Axis Nifty 500 Index Fund or any member of the public regarding the advisability of investing in securities generally or in the Axis Nifty 500 Index Fund linked to Nifty 500 TRI or particularly in the ability of the Nifty 500 TRI to track general stock market performance in India. Please read the full Disclaimers in relation to the Nifty 500 TRI in the in the Offer Document / Prospectus / Scheme Information Document.

Disclaimer: This press release represents the views of Axis Asset Management Co. Ltd. and must not be taken as the basis for an investment decision. Neither Axis Mutual Fund, Axis Mutual Fund Trustee Limited nor Axis Asset Management Company Limited, its Directors or associates shall be liable for any damages including lost revenue or lost profits that may arise from the use of the information contained herein. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s).

The information set out above is included for general information purposes only and does not constitute legal or tax advice. In view of the individual nature of the tax consequences, each investor is advised to consult his or her own tax consultant with respect to specific tax implications arising out of their participation in the Scheme. Income Tax benefits to the mutual fund & to the unit holder is in accordance with the prevailing tax laws as certified by the mutual funds consultant. Any action taken by you on the basis of the information contained herein is your responsibility alone. Axis Mutual Fund will not be liable in any manner for the consequences of such action taken by you. The information contained herein is not intended as an offer or solicitation for the purchase and sales of any schemes of Axis Mutual Fund.

Stock(s) / Issuer(s)/ Top stocks, if any, mentioned above are for illustration purpose and should not be construed as recommendation.

Statutory Details: Axis Mutual Fund has been established as a Trust under the Indian Trusts Act, 1882, sponsored by Axis Bank Ltd. (liability restricted to Rs. 1 Lakh). Trustee: Axis Mutual Fund Trustee Ltd. Investment Manager: Axis Asset Management Co. Ltd. (the AMC). Risk Factors: Axis Bank Limited is not liable or responsible for any loss or shortfall resulting from the operation of the scheme.

(Mutual Fund investments are subject to market risks, read all scheme related documents carefully.)

MUTUAL FUND TOOLS & CALCULATORS

Recent News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025

-

Reciprocal Tariffs: Casting a wider net

Apr 7, 2025

-

Axis MF: Gold and Silver Outlook

Mar 17, 2025

-

Axis AMC appoints Nandik Mallik as Head: Equity & Hybrid for its proposed SIFs

Mar 6, 2025